Top 5 Mistakes RIAs Make in Commercial Real Estate

Mistake Number 1: No allocation to the asset class

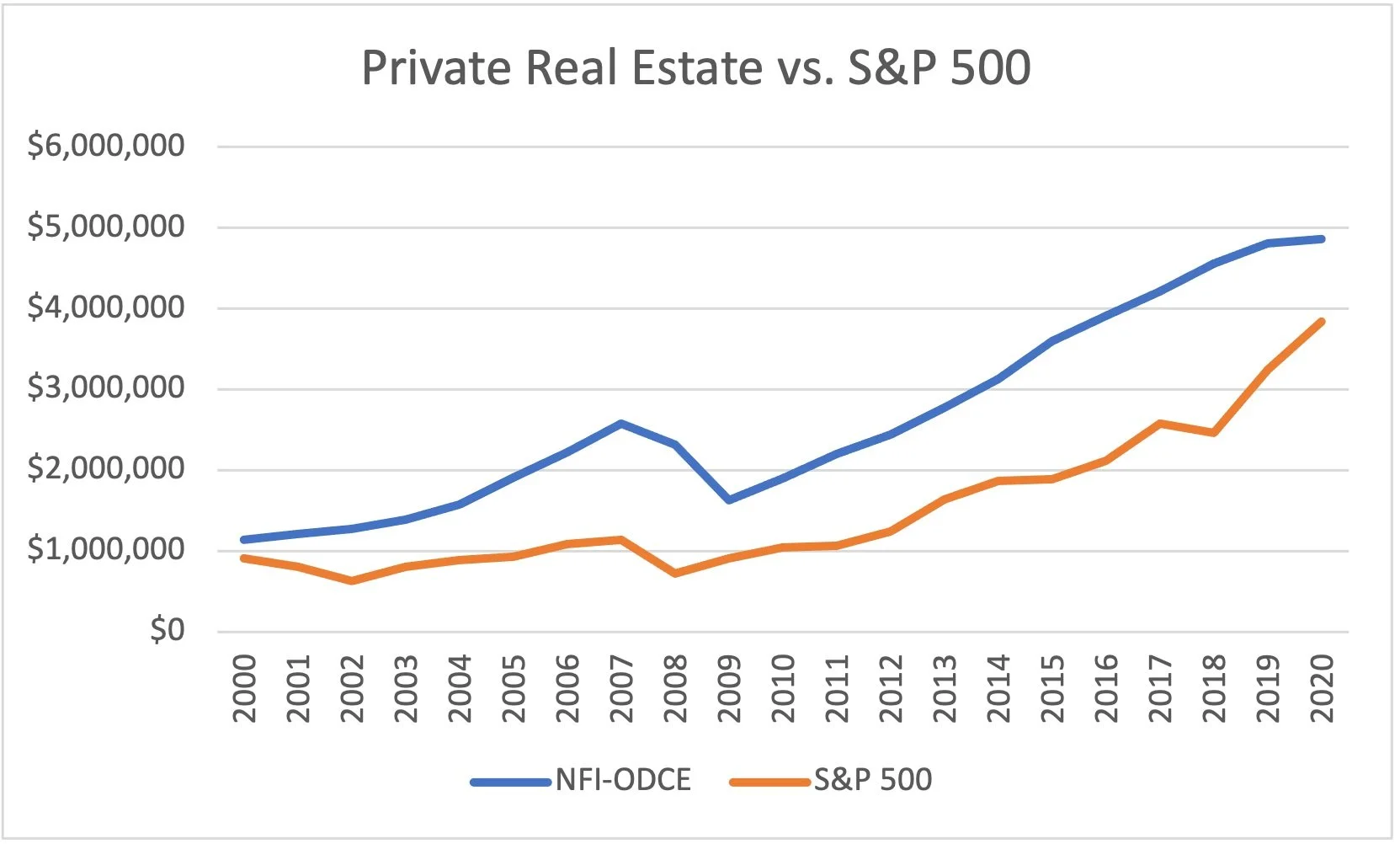

This is a major mistake because many real estate strategies – and private equity real estate in particular – have outperformed stocks. This isn’t just an issue for RIAs and individuals, many institutions and endowments have been underweight real estate in their portfolios and as result, have underperformed their peers. To give you an idea of what many are missing, the below chart is of the NCREIF NFI ODCE index, which is an index of core commercial real estate property types held in diversified funds. The ODCE index typically has lower returns than other private equity real estate strategies and it still outperformed the S&P 500 over the past 20 years.

SOURCE: NCREIF; CRISP

Not only are investors missing a source of return by not making allocations to real estate, but the asset class is uncorrelated with the equity market, provides tax advantages, and inflation protection.

Mistake Number 2: Wrong types of real estate for the needs of the investor

Real estate comes in many flavors – and it is a very diverse asset class. Sky scrapers from Chicago to Dubai are real estate – but so are single family homes, apartment complexes, mobile home parks and industrial facilities. Each segment serves a purpose obviously but as investments - they are not created equal – not by a long shot. Each segment has different risks, different return profiles, different levels of volatility, and different cash yields. At Prairie Hill we exclusively focus on net lease commercial properties – industrial, grocery and certain types of retail – for the low risk, high cash yield and high total returns that we can generate. This profile is ideal for those investors that need to generate dividend income, preserve principal, and have solid returns as well. The key is to match the needs of an investor with the right strategy.

Mistake Number 3: Sole focus on multi-family investments

Multi-family is a sound asset class but we think it suffers from a number of issues that are not well understood by investors:

It is not as recession proof as people think. Yes, tenants are typically going to pay the rent before they pay other creditors, but in a bad economy, people’s ability to pay can be affected to the point where they simply cannot pay the rent. Tenant profiles vary widely in this asset class, but if tenants’ lose their source of income and don’t have reserves, rent collection can suffer.

Capital expenditures are uncontrollable. In multi-family, landlords are responsible for maintenance and capital improvements over time. These expenses can reduce investor returns significantly and often they are difficult to predict because they involve consumer preferences… let’s face it, a person’s definition of what is in style for kitchens, bathrooms and interiors changes over time. What was popular in the 90s is no longer popular. These changes in preferences can result in massive capital outlays in large complexes. Or worse, a landlord decides not to renovate - and a developer builds a new complex nearby and the tenants switch. Then the landlord is left with a situation that involves reduced rents, vacancies, etc. Commercial office real estate suffers from this same issue. We avoid these asset types altogether.

Government Intervention Risks. This is a large topic and much could be written on it – but if the government intervenes in rent control, eviction moratoriums, and the like – you can bet that multi-family is the target of these policies. That was a reality in some areas during 2020-2021.

Mistake Number 4: Lack of Diversification in Real Estate Investments

Many high net worth individuals and RIAs make investments in specific properties directly or through intermediaries. Maybe it is a new apartment complex development, or the acquisition of an office building - but the investment is in a single asset. As an entrepreneurial person, I never would want to dissuade those adventurous individuals that want to invest in a property themselves; but for passive investing with no management responsibilities, making an investment in a single property is not a wise move for RIAs and individuals. Often losses are the biggest threat to retirement security, because they can be so difficult to recover from and a single property has 100% exposure to a particular geography, regional economy, industry, tenant profile, and more. With proper diversification, often these risks are reduced to the point of not having much of an effect on total returns.

Mistake Number 5: Poor alignment between Managers & Investors in fund structure

In typical fund vehicles, the Limited Partners (LPs) are the investors and the General Partner (GP) is the investment manager that buys/sells/develops real estate assets to maximize returns. Unfortunately, there are many investment vehicles out there that have structures that compensate the GPs in such a way that we believe contributes to excessive risk taking in acquisitions. As a fiduciary, understanding risk for your clients is critical, and as an RIA, your entire business is built on the trust that your clients have placed in you to do that. Beware of overly generous fees that kick-in for the GP with high returns. Incentives drive behavior - and while high returns are good - excessive risk taking is most decidedly not.

If you like what we have to say - please follow Prairie Hill on Linkedin to receive notifications of new articles.